What Entropiv Is

Entropiv is a real-time crypto options intelligence system delivered as a cloud-based SaaS platform, an interactive web application, and an API-first service — with on-premise deployment in roadmap. It fuses normalized options and spot data across Deribit, OKX, Bybit, and Coincall, enabling execution-grade visibility into volatility surfaces, arbitrage paths, and pricing anomalies.

Alpha Platform Interface

Real-time Dashboard

Live system status with 52ms latency, volatility snapshot grid showing real-time IV metrics across major assets, and comprehensive market overview with volume tracking and alert monitoring.

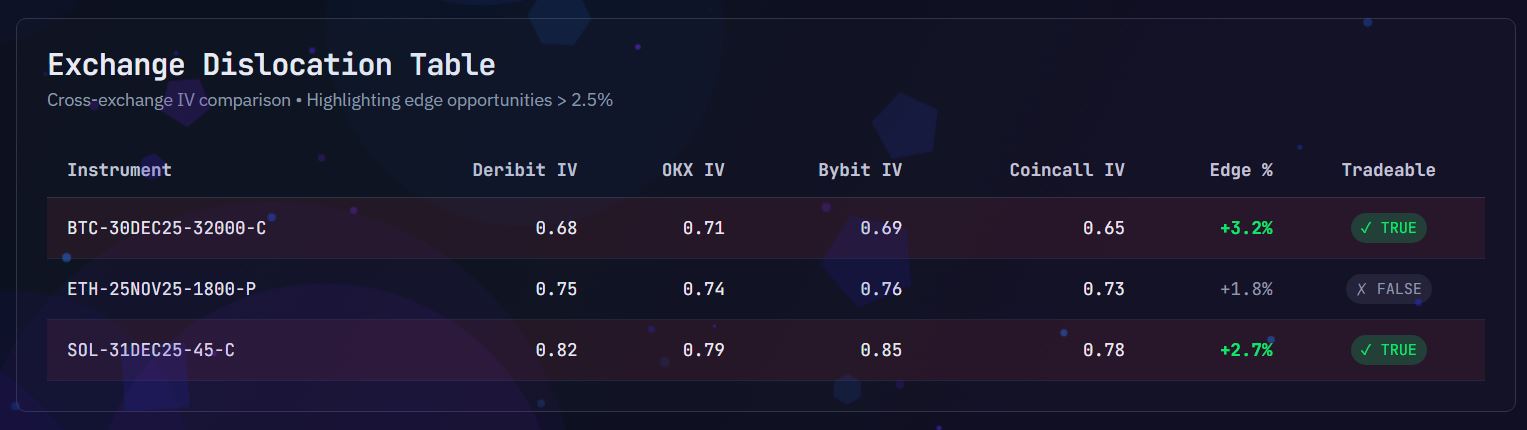

Cross-Exchange IV Comparison

Exchange dislocation table highlighting edge opportunities greater than 2.5%. Shows normalized IV values across Deribit, OKX, Bybit, and Coincall with real-time tradeable status and edge calculations.

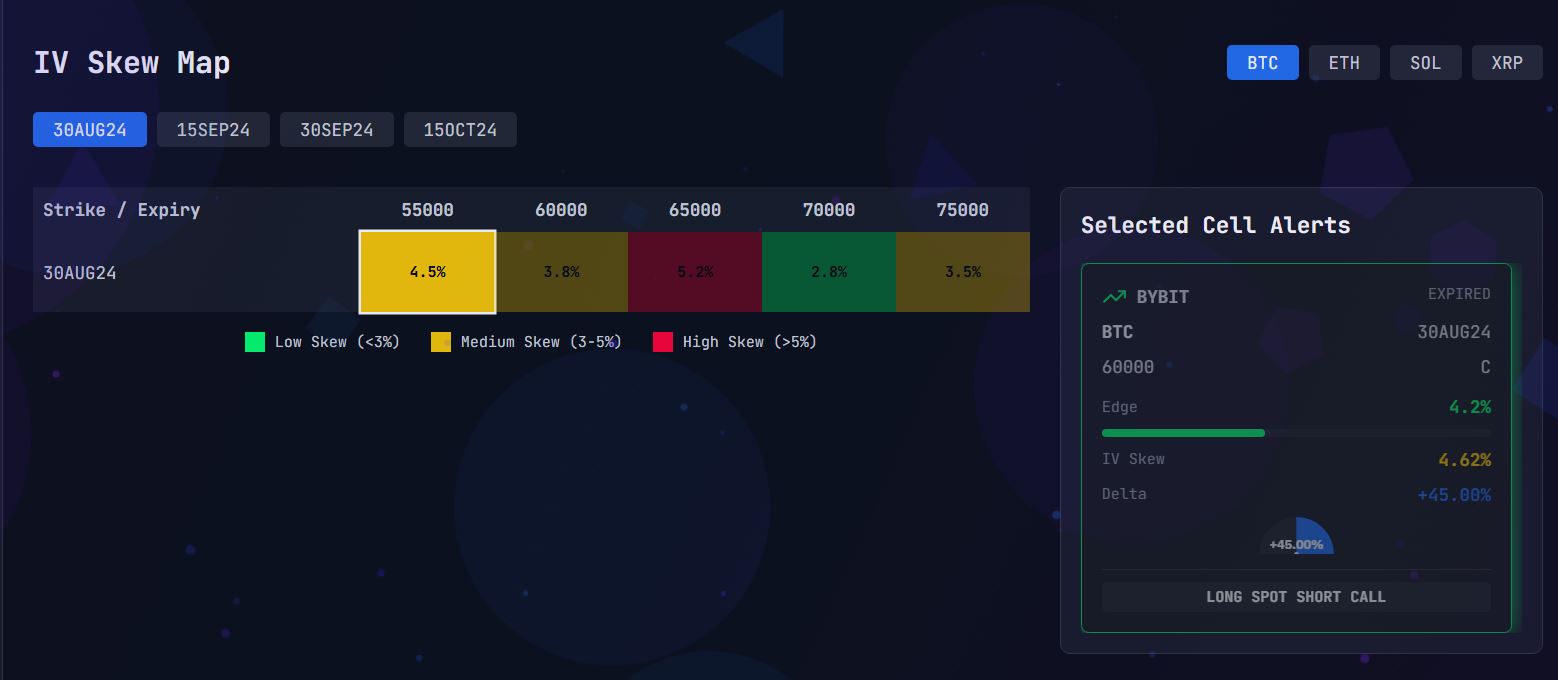

IV Skew Heat Map

Interactive volatility surface visualization with strike/expiry grid showing color-coded skew levels. Includes detailed cell selection with alert configuration for specific strikes and delta exposure analysis.

Options Chain View

Streamlined options chain interface showing bid/ask spreads, delta values, edge percentages, and IV skew across multiple strikes with exchange-specific data.

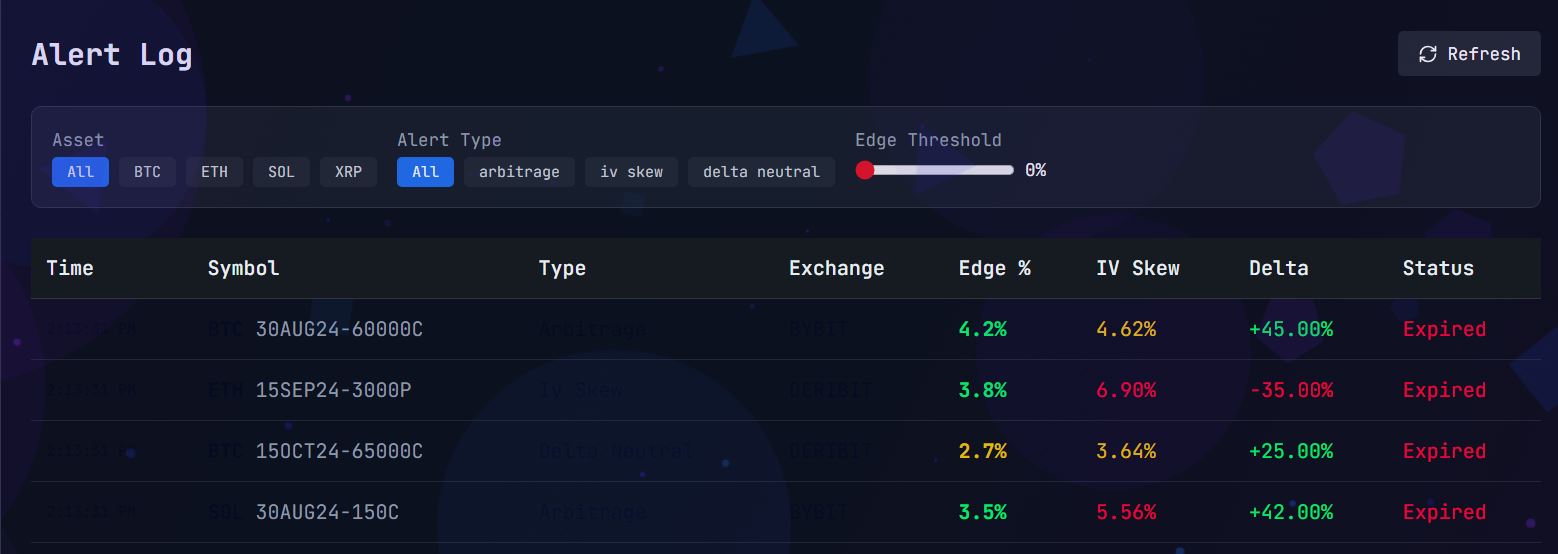

Alert Management

Comprehensive alert log with filterable views by asset, alert type, and edge thresholds. Real-time status tracking with detailed metrics for each arbitrage opportunity.

How Entropiv Works

Data Ingestion Layer

- •Connects to exchange-native APIs for options chains, spot prices, and order books

- •Supports websocket and REST endpoints

- •Latency-aware and built for near real-time propagation

Normalization Engine

- •Translates heterogeneous exchange schemas into a unified internal model

- •Recomputes greeks using Entropiv's internal implied vol surfaces, not stale exchange estimates

- •Adjusts for synthetic spot misalignments and non-standard contract structures

Analytics Core

- •Models interpolated IV surfaces per asset per exchange

- •Flags arbitrage windows, skew/kurtosis divergence, and implied-realized vol mismatch

- •Runs clustering on strike-level distortions and expiries

Delivery Interfaces

Web UI

Interactive dashboards, strike-level breakdowns, time-series arbitrage graphs

API

REST & WebSocket endpoints for fund integration and alert routing

Webhook & Alerting

Custom condition triggers (e.g., delta-neutral edge at 3.5σ)

Technical Specifications

Latency Performance

- • Sub-second data propagation

- • WebSocket streaming for real-time updates

- • Microsecond-precision timestamping

- • Exchange-specific latency compensation

Data Coverage

- • Full options chains across 4 exchanges

- • Spot price feeds with VWAP adjustments

- • Order book depth (L2 data)

- • Historical IV surface reconstruction

Analytics Engine

- • Black-Scholes-Merton with stochastic vol

- • Cubic spline IV surface interpolation

- • Cross-exchange greeks normalization

- • Statistical arbitrage detection

Integration Options

- • RESTful API with OpenAPI spec

- • WebSocket streaming endpoints

- • Webhook notifications

- • Python/JavaScript SDKs

Supported Exchanges

Deribit

Full integration

OKX

Full integration

Bybit

Full integration

Coincall

Full integration

Exchange-Specific Capabilities

Data Normalization

- • Unified contract specifications

- • Standardized greeks calculations

- • Cross-exchange time synchronization

Arbitrage Detection

- • Cross-venue price discrepancies

- • IV surface misalignments

- • Synthetic-spot basis differentials